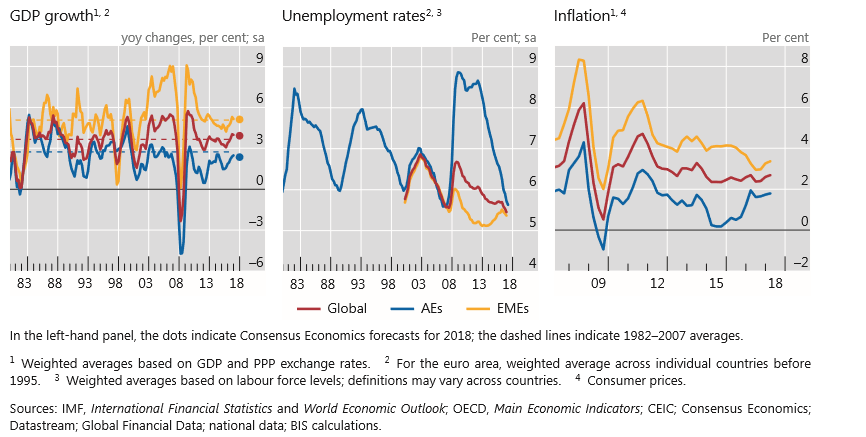

The Bank for International Settlements (BIS) recently came out with their Annual Economic Report for 2018. According to BIS the global economy is strengthening while inflation is converging.

Source: BIS Annual Economic Report 2018

Why should investors not be happy?

According to BIS, there are three potential triggers which might derail the strengthening of the global economies

1-One possible trigger of an economic slowdown or downturn could be an escalation of protectionist measures. Its impact could be very significant, if such escalation was seen as threatening the open multilateral trading system. Indeed, there are signs that the rise in uncertainty associated with the first protectionist steps and the ratcheting-up of rhetoric have already been inhibiting investment. Moreover, were the recent reversal in the US dollar depreciation to continue, trade negotiations would become more complicated.

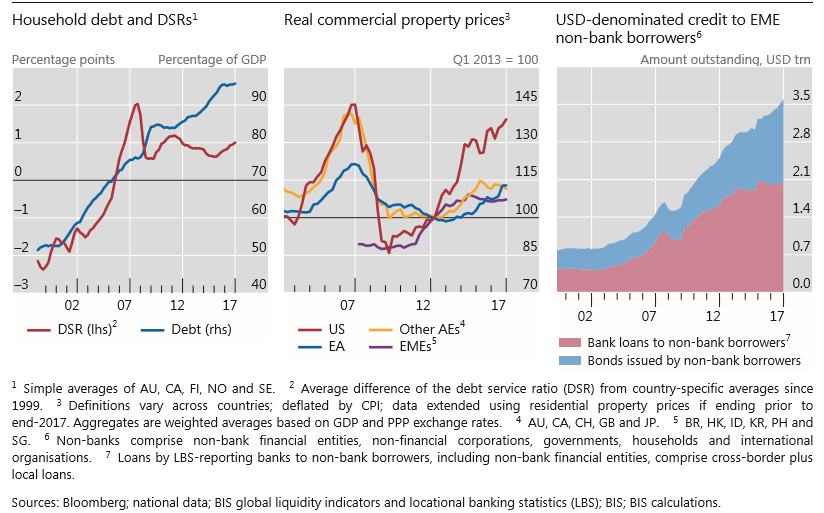

2-A second possible trigger could be a sudden decompression of historically low bond yields or snapback in core sovereign market yields, notably in the United States. This could take place in response to an inflation surprise and the perception that central banks will have to tighten more than anticipated.

Open-end bond funds and exchange-traded funds (ETFs), key buyers of corporate bonds and other fixed income instruments in recent years, are particularly exposed to episodes of rapidly rising rates. This reflects both the induced valuation losses and the redemption pressures caused by declining fund returns. Such redemptions may force sales at large discounts, exacerbating the downward pressure on fund returns and triggering further redemptions. Likewise, ETF investors may find it difficult to sell their shares in secondary markets, with bid-ask spreads often widening as fund returns deteriorate. Several factors may amplify such dynamics. For one, credit spreads are already quite compressed. Bond investors are thus unlikely to benefit from any offsetting effect of tighter spreads during snapbacks. In addition, portfolio duration has increased for many funds, amplifying the valuation impact of rate changes. Persistently low market volatility, notwithstanding recent increases, may have further sustained fixed income positions at low yields, increasing the scope for abrupt sell-offs.

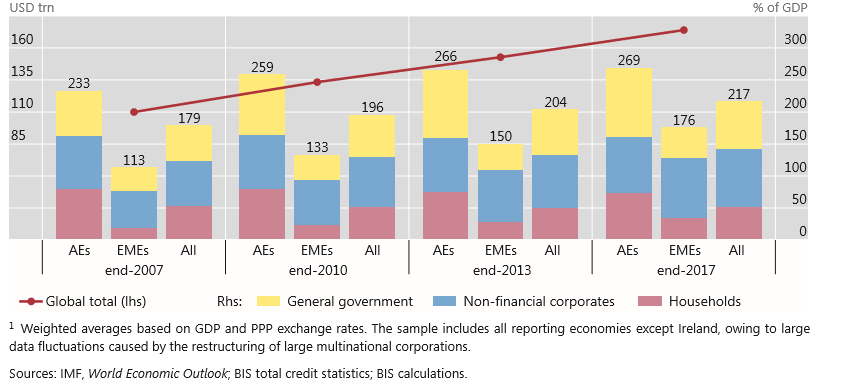

Global Debt continues to Rise

Source: BIS Annual Economic Report 2018

Source: BIS Annual Economic Report 2018

In the United States, the prospective heavy issuance of government debt, combined with the gradual unwinding of central bank purchases, could add to this risk. Importantly, the surprise need not be a large one, as indicated by the financial markets’ wobble in February in response to slightly stronger than anticipated US wage growth. And the impact would spread globally, given the weight of the US economy and the dominant role of the dollar in global financial markets.

Source: BIS Annual Economic Report 2018

3-A third trigger could be a more general reversal in risk appetite. Such a reversal could reflect a range of factors, including disappointing profits, the drag of the contraction phase of financial cycles where these have turned, a souring of sentiment vis-à-vis EMEs, or untoward political events threatening stability in some large economies. From this perspective, recent events in the euro area are a source of concern, as reflected in the widening of spreads on Italian and Spanish bonds. In contrast to the snapback scenario, this third trigger would usher in a further compression of term premia in those core sovereign markets that benefited from a flight to safety.

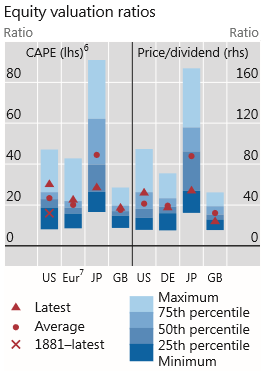

What about market valuations?

BIS looked also closer at market valuations over the last decades. In terms of valuations it was using CAPE, a valuation measure that uses real earnings over a 10-year period to smooth out fluctuations in corporate profits. In order to have a shorter valuation metrics it compared market valuations with equity price to dividend.

Source: BIS Annual Economic Report 2018

BIS Conclusions

Despite the softer patch in the first quarter of 2018 and some jitters in emerging market economies (EMEs), the forecasters’ central scenario is still for global growth to exceed potential, reducing unemployment further, with economies testing capacity limits. Investment is expected to strengthen, boosting productivity over time. And fiscal expansion should provide additional near-term stimulus: quite apart from the measures in the United States, the OECD foresees an easier fiscal stance in around three quarters of its members this year and next.

At the same time, inflation is forecast to edge up. a number of developments could lead to the materialisation of risks, threatening the economic expansion in the medium term. In all of them, financial factors seem destined to play a prominent role, either as a trigger or as an amplifying mechanism.

if the global economy successfully navigates the choppy waters described, the expansion could continue. But then, almost inevitably, supported by easy financial conditions, financial imbalances and, above all, the aggregate debt-to-GDP ratio could rise further. Financial market complacency, low volatility and excessive risk-taking would continue…