When we look at this year´s oracles most of them did not anticipate meaningful corrections in the index (10% move) for the year 2018. Overall the view has been that financials would do rather well and energy stocks would underperform.However, both sectors were down over 10% in 2018. According to Bloomberg the stellar performer was health-care being up some 11% year-to-December 2018.

As Barron´s writes the year 2018 has been unusual in many ways. There was a bear market in the Price-Earnings multiple, but a bull market in earnings. And as Yardeni research highlights, the US economy grew strongly with gross domestic product climbing 4.2% the second quarter and 3.5% in the third quarter.

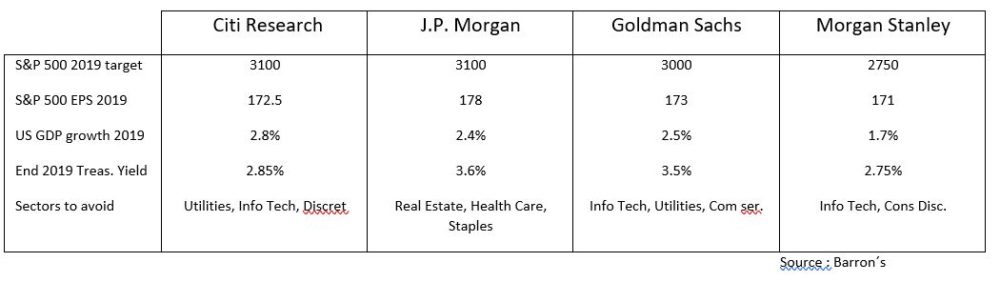

US Investment Outlook 2019

For 2019, there seems to be only some slight divergences with regards to the US market among key investment houses. The most bearish house seems to be Morgan Stanley when it comes to the US financial outlook. It is surprising that most of the investment houses are relatively positive, while it feels much more as though we are at the summit of the current expansionary US cycle. The unemployment rate stands at a 49-year low. As Russell Investments states ´the punitive base effects from the corporate tax cuts, and accelerating input costs point to an even sharper slowing in US earnings growth from 25% to 8% in 2019.

When will we see monetary policy to a restrictive setting? Probably not before the end of 2019/ begin of 2010. It is our belief that the S&P 500 end-year targets given by the selected investment houses will probably be reached before end year, if at all. Let us not forget that the market prices-in a slow-down in earnings 6 months before it happens, so we should not be surprised to see stronger asset revaluations from the third quarter 2019 onwards. This coupled with full valuations makes us less positive on US equities for 2019, and we agree to avoid the Inf Tech sector.

With regards to fixed income markets, we note that they have turned more bearish recently. We do not see any Treasury yields above 3% by end of 2019 simply because of a heightened recession risk. Here we have more sympathy with the forecasts of Citi and Morgan Stanley who predict Treasury yields of 2.75%-2.85%.

`